“Impact of Taxes and Levies on Fuel Prices Soars, KRA to Collect Sh29.2 Billion Monthly”

Date:

September 20, 2023

Nairobi, Kenya – Kenyan consumers are now shouldering a significant tax burden when purchasing fuel, with up to Sh79 in taxes and levies imposed on every litre, further escalating petroleum prices. This development underscores the substantial fiscal impact of these charges, as the Kenya Revenue Authority (KRA) anticipates monthly collections of Sh29.2 billion from diesel, petrol, and kerosene sales.

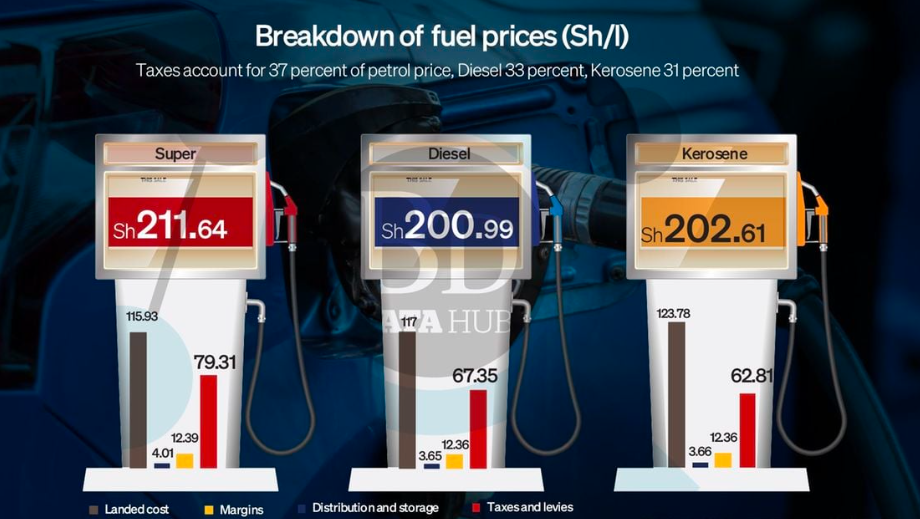

In the most recent price review, a staggering Sh79.31 of each litre of petrol goes towards taxes and levies, with diesel, the most widely used fuel in Kenya, incurring Sh67.35 in taxes per litre. For every litre of kerosene, Sh62.81 is attributed to taxes and levies.

This elevated tax composition is set to see the KRA accumulate an additional estimated Sh5.79 billion per month from these three fuels compared to the Sh23.38 billion collected monthly since September of the previous year, prior to the doubling of value-added tax (VAT) to 16 percent.

The surge in taxes and levies as a component of fuel prices is primarily a consequence of the rise in the landed cost of the commodity and the doubling of VAT two months ago.

In a comparison with the monthly pricing review from October 14 last year, the burden of taxes and levies has increased, with Sh64.14 per litre of super petrol (up from Sh64.14), Sh53.39 for each litre of diesel (up from Sh53.39), and Sh46.81 per litre of kerosene (up from Sh46.81).

The impact of these increased levies has been felt at the pumps, with diesel prices surging by Sh21.32 to reach Sh200.99 per litre in Nairobi in the latest price review. Super petrol prices also experienced a significant hike, rising by Sh13.96 to Sh211.64 per litre, while kerosene registered the highest increase of Sh33.13 per litre, reaching 202.61 effective as of Friday.

Despite public concern regarding the high fuel prices and the resultant effect on the cost of living, President William Ruto has reiterated the government’s stance, asserting that fuel is not overtaxed. This stance remains unchanged, even in the face of growing public discontent.

The taxes, many of which are assessed as percentages, contribute to the escalating final fuel prices as global crude oil costs rise. The primary taxes include excise tax, which is the largest tax per litre on fuel, and VAT. Other levies include road maintenance levy, petroleum development levy, import declaration fee, petroleum regulatory levy, railway development levy, anti-adulteration levy, and merchant shipping levy.

The doubling of VAT in July 2023 through the Finance Act has led to a surge in pump prices and increased tax collections for the KRA. This move was made in conjunction with the discontinuation of fuel stabilization efforts designed to cushion consumers.

While Parliament failed to adopt a report by its Finance committee in 2021 to reduce VAT on petroleum products from eight percent to four percent, the Treasury has historically resisted efforts by lawmakers to lower levies and taxes on fuel products, underscoring their crucial role in the KRA’s revenue generation.

In light of these developments, the Treasury has announced that excise duty on fuel will be revised upwards by April next year, further burdening consumers. The move aligns with conditions set by the IMF under a financing deal and is intended to address the negative environmental effects associated with fossil fuel consumption, possibly through the introduction of a carbon tax or an increase in the excise tax on fossil fuels.

The escalating tax burden on fuel, coupled with global increases in crude oil prices and policy decisions, presents Kenyan consumers with continued challenges at the pump and in their daily lives.